Discover the surprising ways the economy affects your wallet, from Wall Street to Main Street. Don’t miss this eye-opening post!

Image courtesy of Meszárcsek Gergely via Pexels

Table of Contents

These days, it seems like we are constantly bombarded with news about the economy and its effects on our daily lives. From stock market fluctuations to job market trends, it can be overwhelming to keep up with all the information. However, understanding how the economy works and its impact on your personal finances is crucial for making informed decisions about your money. Let’s delve into the world of economics and finance to see how it all connects from Wall Street to Main Street.

Market Trends and Financial News

Keeping a pulse on market trends and financial news is essential for staying informed about the state of the economy. Whether it’s tracking the performance of major stock indices like the S&P 500 or keeping an eye on interest rates set by the Federal Reserve, staying up-to-date can help you make informed decisions about your investments and financial planning.

Financial news outlets provide valuable insights into how global events, corporate earnings reports, and government policies can impact the economy. By staying informed about these factors, you can better understand the forces driving the economy and how they may affect your personal finances.

Investment Tips and Personal Finance Advice

When it comes to managing your money, having a solid understanding of investment principles and personal finance is key. Whether you’re looking to grow your wealth through stock market investments or save for retirement through a 401(k) plan, having a strategy in place can help you achieve your financial goals.

Investment tips from financial experts can provide valuable guidance on where to put your money and how to diversify your portfolio to mitigate risk. From the importance of saving for emergencies to the benefits of long-term investing, taking control of your financial future starts with educating yourself and making informed decisions.

Market Volatility and Economic Indicators

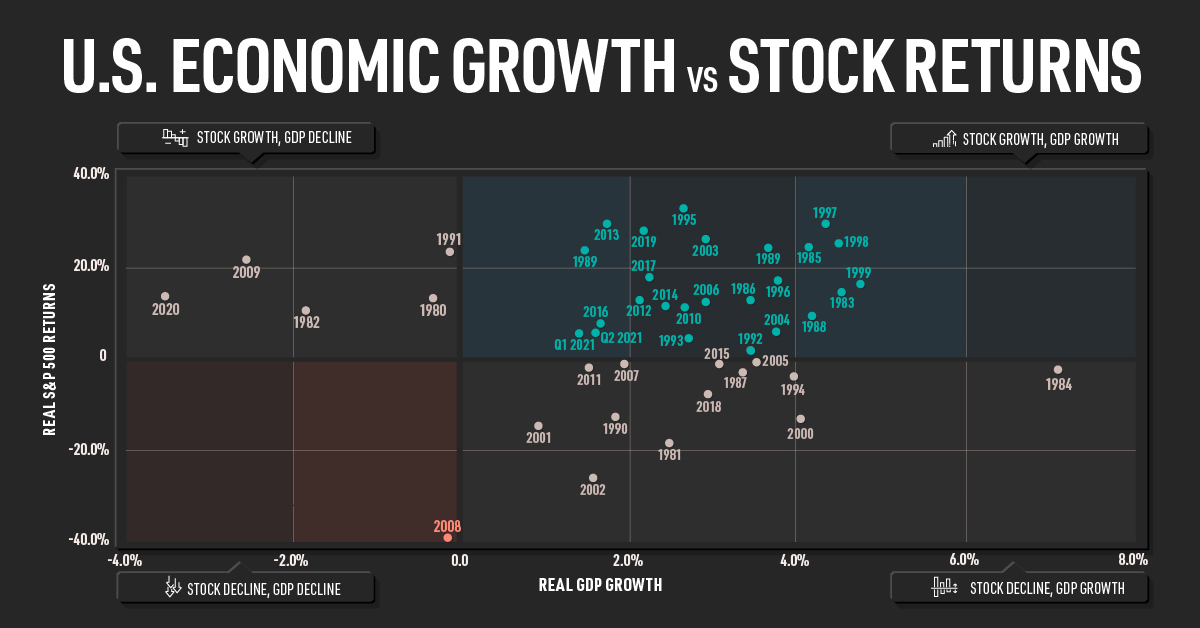

Market volatility is a common occurrence in the world of finance, with prices of stocks, bonds, and other assets fluctuating based on a variety of factors. Understanding the causes of market volatility and how economic indicators such as GDP growth, inflation rates, and unemployment numbers can impact the financial markets is essential for navigating turbulent times.

Image courtesy of via Google Images

Economic indicators provide valuable insights into the health of the economy and can help you anticipate potential changes in market conditions. By staying informed about key economic indicators and their implications, you can make more informed decisions about your investments and financial planning.

Financial Literacy and Education

Financial literacy is an important skill that can empower you to take control of your money and make informed decisions about your financial future. From understanding basic concepts like budgeting and saving to more advanced topics like investing and retirement planning, having a strong foundation in financial literacy can set you up for long-term success.

There are many resources available to help improve your financial literacy, from online courses and educational websites to books and workshops. By investing in your financial education and seeking out opportunities to learn more about personal finance, you can build the knowledge and skills you need to achieve your financial goals.

Conclusion

Understanding the impact of the economy on your finances is essential for making informed decisions about your money. By staying informed about market trends, investment tips, economic indicators, and financial literacy, you can take control of your financial future and work towards achieving your financial goals. So, whether you’re a Wall Street pro or a Main Street shopper, remember that knowledge is power when it comes to navigating the world of finance.

Generated by Texta.ai Blog Automation